Introducing the DeFi Stars Cellar Strategy: A Framework for Sustainable Growth

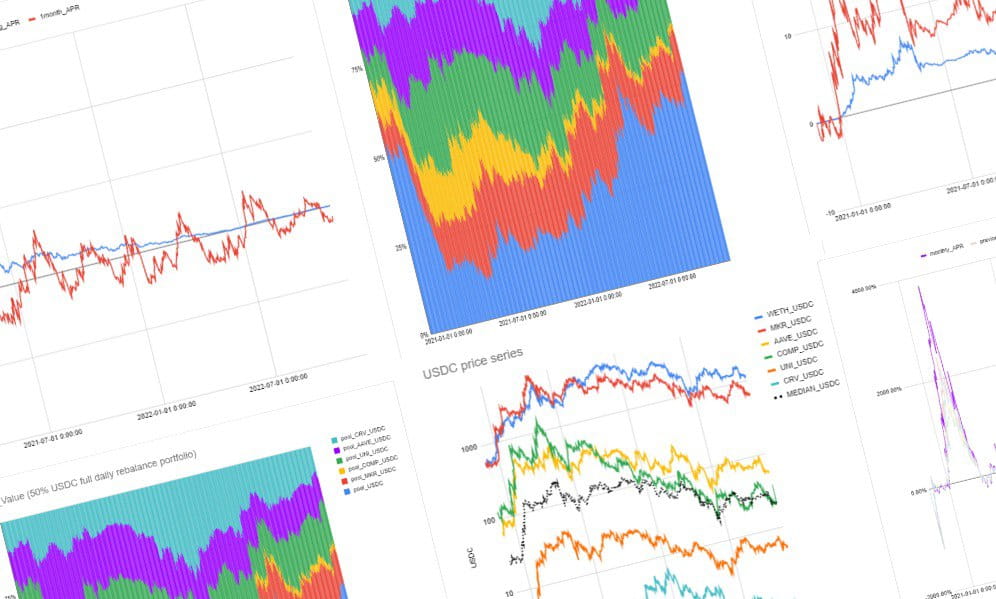

The DeFi Stars Cellar strategy provides a framework for users to achieve strong growth in their portfolio by focusing on safe and high-cap assets that offer significant rewards in a future where DeFi increases adoption. The strategy proposes an initial portfolio composed of MKR, AAVE, COMP, LDO, CRV as speculative tokens and USDC as a risk-off asset, with a default portfolio distribution of 50% USDC to reduce risk and capture later opportunities.

To evaluate the effectiveness of the proposed strategy, we compare the portfolio's performance against a benchmark scenario of holding assets with no stop plans for price or time levels. We evaluate the strategy using Return on Equity (ROE), Maximum Drawdown (MDD), and Sharpe ratio, which is a popular indicator for portfolio tracking.

Overall, the DeFi Stars Cellar strategy provides a disciplined and diversified approach to DeFi space, helping users manage risk and optimize returns over time. The rebalancing strategies proposed in the report offer a significant improvement over the benchmark scenario and can help users achieve their goals.

Continuous DeFi asset monitoring for performance/capitalization allows us to obtain the best portfolio diversification for our strategy in this domain. Our strategy will have an initial best 5 assets and a stablecoin.

React quickly to market changes by capturing upside breakouts and managing downtrends. Utilize a long-only approach in established DeFi assets during markup periods.

Our system is running parallel backtesting using machine learning algorithms to determine the most optimized parameters to use for the trend indicators, allocation range buffers, and dynamic stop loss.

Trend detection is based on a custom indicator set by optimized parameters. The trend is used to determine the direction for portfolio rebalancing for each asset.

Actual portfolio allocation will appear different than our targeted portfolio as a result of the allocation speed of change over time. This speed of change is another optimized parameter from our previous step.

Gas fees will be inferred and monitored, and based on our current TVL, we will run periodic opportunistic decisions to decide if and when to execute rebalancing swaps transactions inside our Cellar.